by Mark Skousen, Investment U Research

Friday, March 15, 2013: Issue #1991

?How do you make a million? Borrow a million, invest it in real estate, and pay it off.?

- Jack Miller

I just returned from a weeklong Royal Caribbean cruise on the ?Freedom of the Seas? (great ship) sponsored by The Real Estate Guys Robert Helms and Russell Gray, who have their own radio show and are regular speakers at FreedomFest. Most of my family joined me and we had a great time.

For me, the highlight was a debate on ?Which Investment Asset is Best: Stocks, Bonds, Gold/Commodities, or Real Estate??

They each have their pros and cons.

I have invested in all four categories, but I think stocks are the best way to go because of their variety, profit potential (both short and long term), tax breaks and liquidity. And right now stocks are the hottest investments, with the Dow hitting a new high almost every day.

But most of the speakers on this cruise were experts in real estate. As an investment class, it still suffers from several negatives, especially:

- Liquidity (ability to sell quickly)

- High levels of debt

- A large amount of paperwork and transaction fees

My wife and I just went through a refinancing of our mortgage and it was insane what the bank demanded from us ? in additional paperwork and fees.

Buying and selling a stock may cost pennies, but a real estate transaction will cost thousands in closing costs.

A better alternative is to invest in real estate stocks. These offer much better liquidity, high profit potential and generous positive cash flow ? without all the transaction expenses and landlord headaches. And if another collapse in property is heading your way, like what happened in 2008, it?s much easier to sell a stock certificate than a property deed.

My favorite real estate stocks right now are: Equity Residential (NYSE: EQR), which invests in apartments; Inland Real Estate (NYSE: IRC), which specializes in shopping centers; Medical Properties Trust (NYSE: MPW), which invests in hospitals; and Health Trust of America (NYSE: HTA), which owns nursing homes. Real estate related to healthcare is hot right now because of Obamacare and an aging population.

Despite all the negatives, investing in rental properties still has a certain allure to investors, especially those who are down on their luck and want to make a lot of money fast. The fact is real estate still offers a person the chance to turn a small investment into a large one fairly quickly if you play your cards right and are willing to be an entrepreneur in the face of high risks.

For example, I met one attendee on the cruise who had only a few dollars to his name, yet was able to buy a dozen properties with nothing down over the course of a few years and leverage his way to a wealthy lifestyle ? enough to come on an expensive cruise to the Caribbean.

The only way to do this, of course, is by using owner financing. That is, by arranging for the seller to hold the mortgage and even to finance the closing costs. In today?s world, commercial banks no longer allow ?no doc,? or subprime loans (outside of the FHA!).

Creative real estate investors reduce or eliminate their taxes primarily by taking advantage of generous depreciation rules on their rental properties. Tom Wheelright, CPA and author of Tax Free Wealth, specializes in devising powerful tax deductions. He gave several talks on the cruise on how to leverage your way to tax-free profits if you know how to use the tax code to your advantage.

Good Investing, AEIOU,

Mark

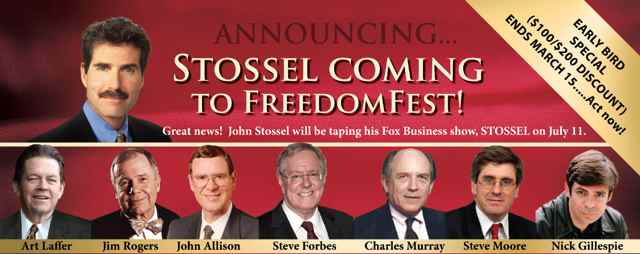

Early Bird Special Ends This Weekend for FreedomFest!

P.S. The Real Estate Guys are returning to FreedomFest this July 10-13, at Caesars Palace. They loved our two-minute video preview, ?Are We Rome?? ? you can watch it here: http://vimeo.com/45821274

THE ?EARLY BIRD? SPECIAL HAS BEEN EXTENDED TO SUNDAY, MARCH 17 FOR IU READERS: Save $100 per person ($200 per couple) on ?the greatest libertarian show in earth,? July 10-13, 2013, at Caesars Palace in Las Vegas. Over 600 attendees have already signed up, and we expect to SELL OUT this year with over 3,000 attendees. Main reason: John Stossel is bringing his Fox News show to FreedomFest on July 11 (7-11) ? and you are guaranteed an upfront seat at no extra charge. Over 150 speakers and all the major think tanks and freedom organizations. Jeffrey Tucker (Laissez Faire Books) calls it ?the central meeting place for all freedom lovers? and Steve Forbes says ?it is the only conference I attend in its entirety.? Alexander Green says, ?Next to my wedding day and the birth of my children, FreedomFest was the highlight of my life.? Hope you can join us: Register now at www.freedomfest.com, or call Tami Holland at 1.866.266.5101 and mention Investment U.

Is it Really Possible to Make Millions in Real Estate Without Paying Taxes?,VN:F [1.9.16_1159]

Rating: 5.0/5 (1 vote cast)

Source: http://www.investmentu.com/2013/March/make-millions-in-real-estate-without-paying-taxes.html

Jennifer Granholm Tulane player injured fox sports obama speech Art Modell Frank Ocean Gay bill clinton

No comments:

Post a Comment